Both FSA and HSA pre-tax health accounts can be used to pay for prescription glasses, contact lenses, eye exams and more. Eyewear that corrects your vision is considered a medical product, which means you can use your health plans to help cover the cost.

So what exactly are pre-tax health accounts? How do they work and how else can you use them for your eye care needs?

Understanding How Pre-Tax Health Accounts Work

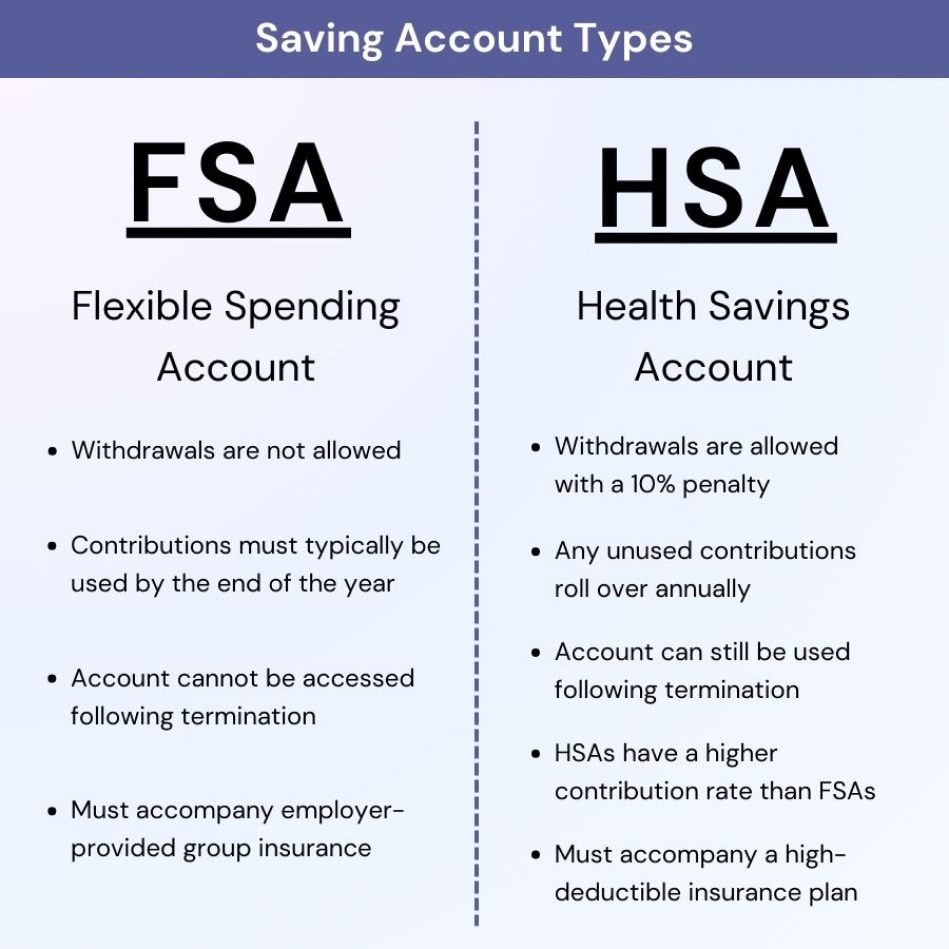

Pre-tax health accounts provide a way for you to pay for out-of-pocket expenses that your insurance doesn’t cover. Here’s how the different accounts compare:

Flexible Spending Accounts (FSAs)

An FSA is an account with pre-taxed funds withdrawn from each paycheck, or from a lump sum at the start of the year. These funds can help pay for health products and services that your insurance may not cover.

Many employers provide an FSA option in their insurance benefits package(s). FSAs must be used in conjunction with this health insurance plan provided by your employer. If you stop working for the company that provides the FSA, you’ll no longer have access to the account.

Depending on your employer’s plan, FSA funds may not not roll over into the following year. You have to spend the money in your account by the end of the plan’s term or the funds will expire. In other words, use it or lose it.

Some FSAs are offered with a rollover or grace period. There’s a limit to how much money can be carried over, and, if a grace period is implemented, a limited time in which those funds can be used.

Things like prescription eyewear, prescription contacts and other items that correct vision are covered by an FSA.

Health Savings Accounts (HSAs)

An HSA is a savings account with funds taken from pre-taxed salary money. Like an FSA, these funds cover expenses that may not be covered by insurance. HSA funds automatically roll over into the following year and do not expire.

HSAs are used either alongside an individual health insurance plan, or a plan provided by your employer. If you are using an HSA with your employer’s insurance plan, both you and the company can make contributions to the account. (The IRS determines the maximum amount of contributions allowed each year.)

Funds in an HSA can be put toward several different eye care products and services, such as prescription glasses and eye exams. But you can only use your dollars on things that can be considered an aid or correction for your vision.

Even if you leave the job that provides your HSA, you will still have access to your funds.

Health Reimbursement Accounts (HRAs)

Health reimbursement accounts (sometimes called health reimbursement arrangements) are health plans funded and owned by an employer. If you have an HRA, you’ll get reimbursed for qualifying out-of-pocket expenses. But whether or not your expenses qualify for reimbursement is up to your employer.

This type of plan is customized by the organization that owns it. That being said, your employer also gets to decide whether or not the funds in the account roll over into the following year.

Some other factors: You can’t contribute to an HRA; only your employer can. The money provided in an HRA is not taxed. And if you leave the company that owns the HRA, you lose access to the money in your account.

Limited-Care Flexible Spending Accounts (LCFSAs)

A limited-care FSA (also called a limited-purpose FSA) is a plan that covers only preventive care, vision care and dental care. It can also be used to describe a plan that is limited to specific health care costs chosen by an employer (some choose only to cover copays and deductibles).

An LCFSA can be used in combination with an HRA or an HSA.

The two account types we will focus on are FSAs and HSAs.

Which Vision Expenses Are Covered by an HSA or FSA?

Most products and services that correct your vision can be paid for with HSA or FSA funds, including:

- Prescription eyeglasses

- Prescription sunglasses

- Reading glasses (prescription and over the counter)

- Eye drops

- Contact lenses, cases and solution

- Eyeglass cases

- Repair kits for eyeglasses

- Cleaning supplies for glasses or contacts

- Eye exams

- Eye surgery

Some providers also cover blue-violet light filtering glasses, even if they don’t have prescription lenses. Be sure to check with your provider to see what is covered and what is not before you start shopping.

Which Vision Expenses Are Not Covered by an HSA or FSA?

HSA and FSA funds do not apply to non-prescription eyewear (though there may be a few exceptions, depending on your plan). If you’re unsure about a product, ask yourself, “Will this help correct my vision?” If the answer is no, it probably isn’t covered.

The following eyewear and eye care costs are typically not covered under HSA or FSA funds:

- Non-prescription eyeglasses

- Regular (non-prescription) sunglasses

- Non-prescription contact lenses (such as Halloween or costume contacts)

- Non-prescription colored contact lenses

- Insurance premiums

But what about reading glasses? Over-the-counter reading glasses do not require a prescription but they are covered by your funds since they still aid in vision.

Regular sunglasses are not HSA- or FSA-eligible — ultraviolet (UV) protection alone is not considered to be a tool for correcting vision. However, some plans do cover blue-violet light filtering glasses.

And, while insurance premiums are not covered, you can use your FSA or HSA funds to pay deductibles and copays.

How and Where Can I Use My HSA or FSA to Buy Glasses?

You can buy glasses and contacts with HSA or FSA funds online, in optical stores and through your eye doctor’s office.

If you have an FSA or HSA debit card, all you have to do is use that card when you check out with your glasses or contacts at your preferred store.

If you don’t have a debit card for your account, the particular store doesn’t accept it, or you forget to use it, you can apply for reimbursement for eligible expenses through your plan provider. Double-check to see if you need to submit any documents in addition to your receipt.

Note: Walmart specifically does not accept HSA or FSA debit cards as payment. If you buy your glasses here, be sure to get a receipt and any other documentation you may need for reimbursement.

When Should I Use My HSA or FSA Benefits?

HSA funds roll over from year to year and from job to job, as long as you elect a high-deductible insurance plan (whether it’s an individual plan or one provided by your employer).

FSA contributions are a little different. In most cases, the funds in your account must be used by the end of the year (though some employers offer a rollover). You also have to use your account while you are working for the employer that provides the FSA.

Final Thoughts

Pre-tax health accounts make it possible to save money on medical expenses, including eye care. Find out what benefits you have access to and plan ahead when determining how much to put in your FSA or HSA for the following year. For example, if you’re expecting to have vision surgery one year, you’ll want to allocate more than if you just plan to get your regular comprehensive eye exam and a new pair of glasses.